IDTechEx discusses why OEMs are investing in LIB recycling

Maryam Farag

Industry Automotive Manufacturing automotive Canada COVID-19 Economy Li-ion battery manufacturing OEMs recycling Technology

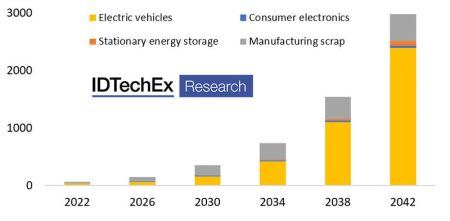

Global Li-ion battery recycling market: by sector (GWh). Source: IDTechEx.

According to IDTechEx, the profitability of recycling is dependent on EV battery trends, and OEMs (original equipment manufacturers) will play a role in facilitating circularity in the battery supply chain.

The economics of recycling primarily depends on three factors: Li-ion battery chemistry, metal prices, and process costs, which are expected to decrease as recyclers scale. There is a lot of variety between the chemical composition of EV batteries, particularly in the cathodes. The demand for higher energy density in EV batteries is causing a shift towards higher nickel cathodes, however the desire to drive battery costs down favors lower-value LFP cathodes – which some OEMs have recently switched to for their entry-level models. This is likely to impact the value of metals recyclers can extract from end-of-life EV batteries.

The most value can be extracted from LCO cathodes due to their high cobalt content, but these are typically used in consumer electronics which will account for a small percentage of Li-ion batteries recycled and are challenging to develop collection networks for. In the report ‘Li-ion battery recycling market 2022-2042’ the recycling value of each cathode type is compared. IDTechEx have investigated these trends and their impact, alongside metal price, to evaluate the economics of the Li-ion battery recycling market.

OEMs are often responsible for EV batteries when they reach their end-of-life. Therefore, it is in the OEMs’ best interests to develop efficient, economic routes for waste end-of-life batteries, and the environmental credentials associated with recycling are also beneficial.

Volkswagen is developing a vertically integrated recycling and second-life business through ‘Volkswagen Group Components’ and commissioned a pilot plant for recycling Li-ion batteries in 2021.

Differing from most EV OEMs, Renault operates a battery hire scheme on three of its models, as well as full ownership options. Renault optimizes the end-of-life management of its EV batteries using second-life applications and recycling with partners, such as Veolia.

Tesla claims to be developing a battery recycling system at its Gigafactory in Nevada, having relied on third-party recyclers in the past, and BMW have formed partnerships with recyclers, seeking to design cells with recycling in mind.

Accoriding to IDTechEx, involvement of these major OEMs looking to boost the sustainability of their EVs reflects the anticipation of the part Li-ion battery recycling will play in the future value chain. Not only are the OEMs likely to carry a legal responsibility for end-of-life Li-ion batteries, but the trends they influence will impact the profitability of recycling. In addition to creating partnerships with recyclers from other sectors, OEMs themselves are acting and investing in their own processes and supply circularity.