2022 Salary Survey: Salaries Dip

Mario Cywinski

Business Operations Economy In-Depth In-Depth Industry Operations Aerospace Automotive Chemicals Construction Electronics Energy Food & Beverage Forestry Government Manufacturing Resource Sector Transportation average age covid-19 impact Demographics Editor Pick experience and skills gender issues job title level of education management issues most important skills pay perks revenue salary comparison salary survey skill shortageWhile executive salaries fell, the average age of respondents moved younger.

Photo: Worawee Meepian/iStock/Getty Images Plus/Getty Images

Photo: Plant Magazine.

In 2021, Plant magazine ran its salary survey as COVID-19 restrictions were in place around many parts of the country, with COVID-19 protocols (which were introduced in 2020) being the norm across the manufacturing industry.

When we sent out the 2022 EMC-PLANT Manufacturing Salary Survey, from March to June, the landscape around the pandemic had shifted. We have entered a neo-COVID period, where it is still considered, but life is going back to (almost) normal.

Once again, the survey was jointly conducted by Excellence in Manufacturing Consortium (EMC), a national not-for-profit organization based in Ontario, and Plant magazine, a part of Annex Business Media. In all, 308 company executives, and senior management level personnel completed the survey, with an additional 11 answering at least part of the survey. For a total of 319 usable submissions.

JOB MOVEMENT AND COVID-19 IMPACT

Photo: Plant Magazine.

Starting in 2020 and into 2021, many companies had to cut shifts, lay off employees, and temporarily or permanently close their doors due to COVID-19. In 2022, a larger portion of respondents moved to a new organization (eight per cent), while one per cent of respondents said they were laid off from the organization they worked for. The largest groups were: same job and salary but more responsibility due to reduced staff (26 per cent), and no change (46 per cent). Positively, 11 per cent of respondents were promoted.

Only 11 per cent of respondents believe their employment status change was a result of COVID-19 in 2022, while 43 per cent said they had no change in employment status, 40 per cent said their employment status change was not a result of COVID-19, and five per cent were not sure. When asked if COVID-19 affected their compensation, 15 per cent said it had a negative impact, with 10 per cent said it had a positive impact, and 75 per cent said it had no impact.

Photo: Plant Magazine.

“Our view is that it has caused manufacturers to look more carefully at ways to ensure production is sustained when one or more elements of people, plant and/or process are impacted by external factors,” said Scott McNeil-Smith, vice-president, manufacturing sector performance, EMC.

“Whether COVID-19 or other human illness, scarcity of supply/disruptions/costs, technology and other impacts such as cyberattacks, manufacturers better understand that having clear strategies for securing people, plant and process is vital to their immediate and long-term future, regardless of the opportunities, challenges or threats to success.”

EXPERIENCE/SKILLS

Photo: Plant Magazine.

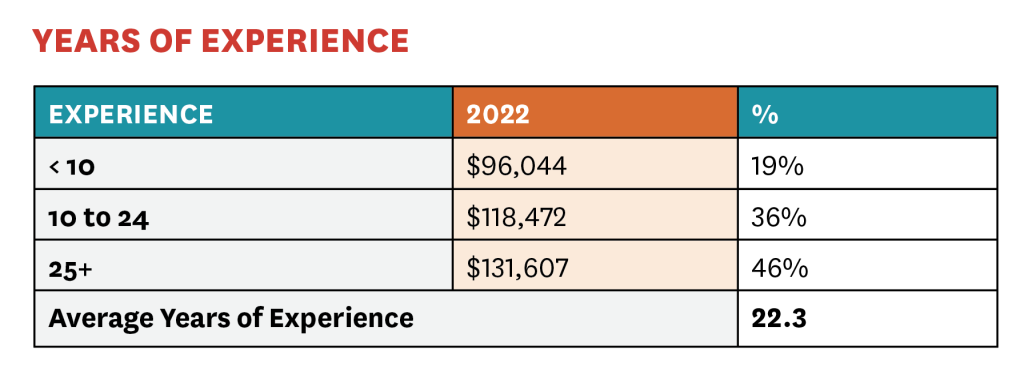

From 2019 to 2021, the average years of experience in the industry went from 25.4 to 25.9 years. However, in 2022, that number dropped to 22.3 years. A majority (46 per cent) of respondents have been in the industry for over 25 years, while 36 per cent at 10 to 25 years, and 19 per cent with less than 10 years’ experience. What has changed year-over-year is that the over 25 years group is shrinking, and those with less experience is increasing, especially those with under 10 years’ experience.

Looking at how long respondents have been in their current jobs, the average time has dropped to nine years (from 12.9 years in 2021), 12.6 in 2020, and 12 in 2019). In all, 66 per cent have been in their current jobs for less than 10 years, with 25 per cent 10 to 25 years, and nine per cent over 25 years. In what has become the norm, years with the current company continues to decrease, down to 12.1 years, down from 16.4 in 2021. Years with the current company breaks down to 50 per cent (less than 10), 35 per cent (10 to 25), and 15 per cent (over 25).

Photo: Plant Magazine.

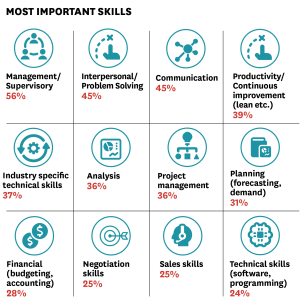

Moving on to skills, the survey found that the top skills that respondents feel they need more training, include: financial budgeting and accounting (27 per cent), industry specific technical skills (26 per cent), people; interpersonal, relationship, management (25 per cent), productivity and continuous improvement (24 per cent), project management (24 per cent), and technical; software and programming (21 per cent).

Compared to the skills respondents feel are most needed in a job today: management supervisory at 56 per cent, communication at 45 per cent, interpersonal problem solving at 45 per cent, Productivity and continuous improvement at 39 per cent, and Industry specific technical skills at 37 per cent. It is clear that the skills workers need improvement in, are not all in demand.

Photo: Plant Magazine.

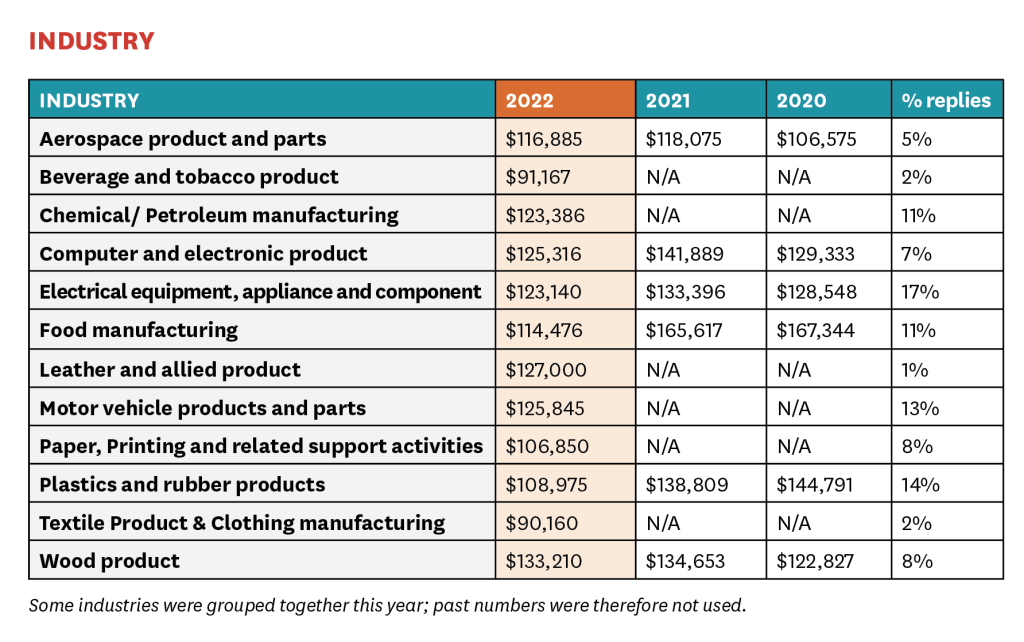

The manufacturing sector is very diverse and has many different organizations. We amalgamated the list of sectors for 2022, to have a smaller number of categories. The most common include: electrical equipment, appliance, and component (17 per cent), plastics and rubber products (14 per cent), motor vehicle products and parts (13 per cent), chemical and petroleum manufacturing (11 per cent), and food manufacturing (11 per cent).

Photo: Plant Magazine.

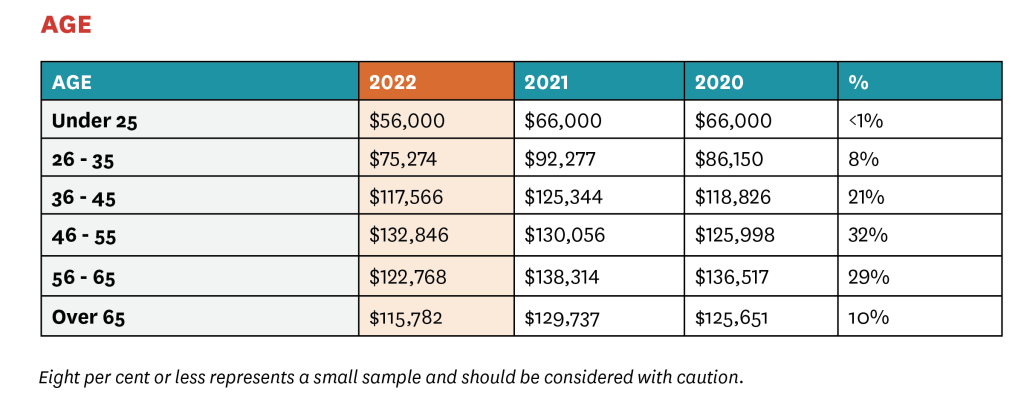

With the average age dropping to 51.1 years old in 2022 (from 53.7 in 2021), and as more people are leaving the industry (namely retirement), new talent has a plethora of options for a career in manufacturing.

SALARIES DROP

Photo: Plant Magazine.

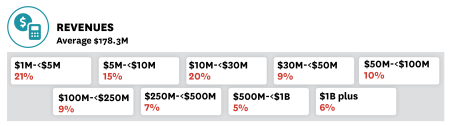

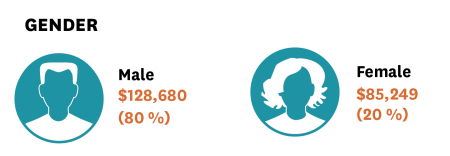

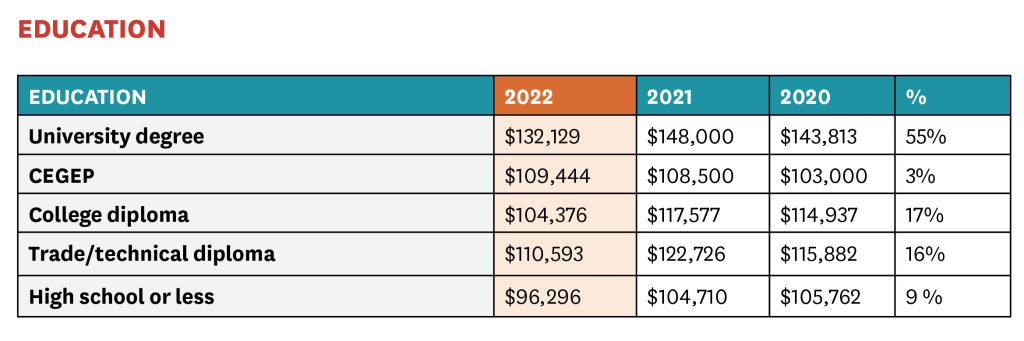

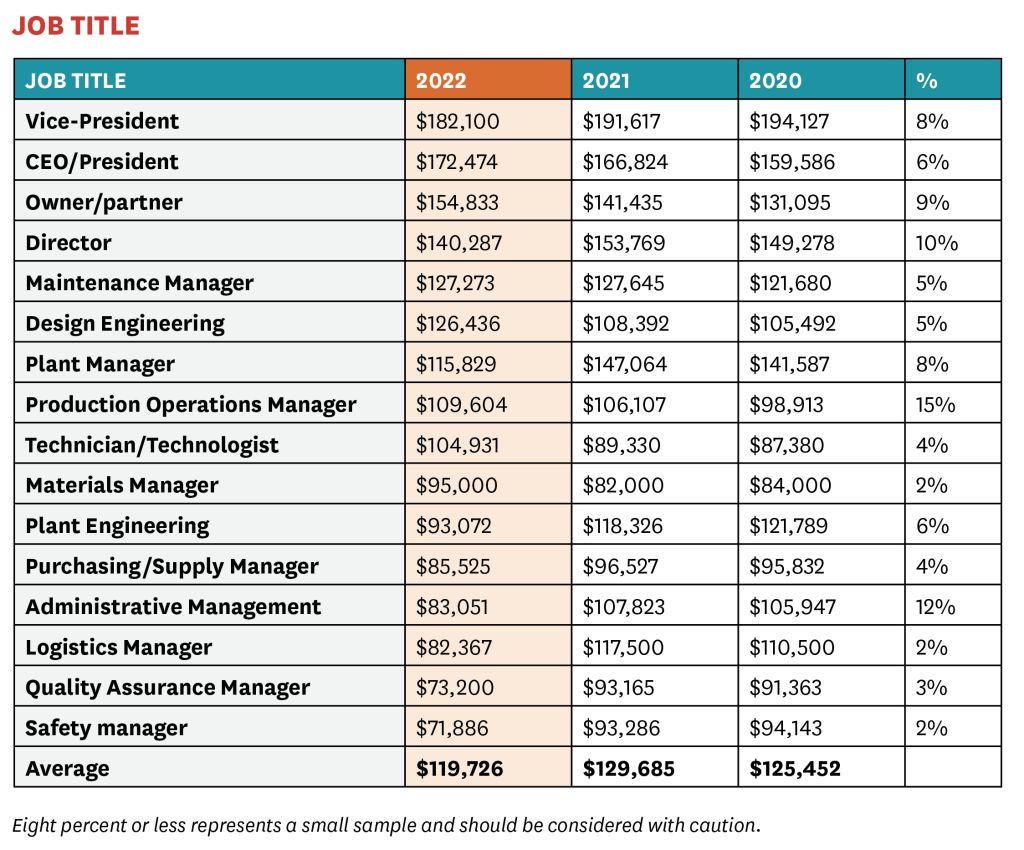

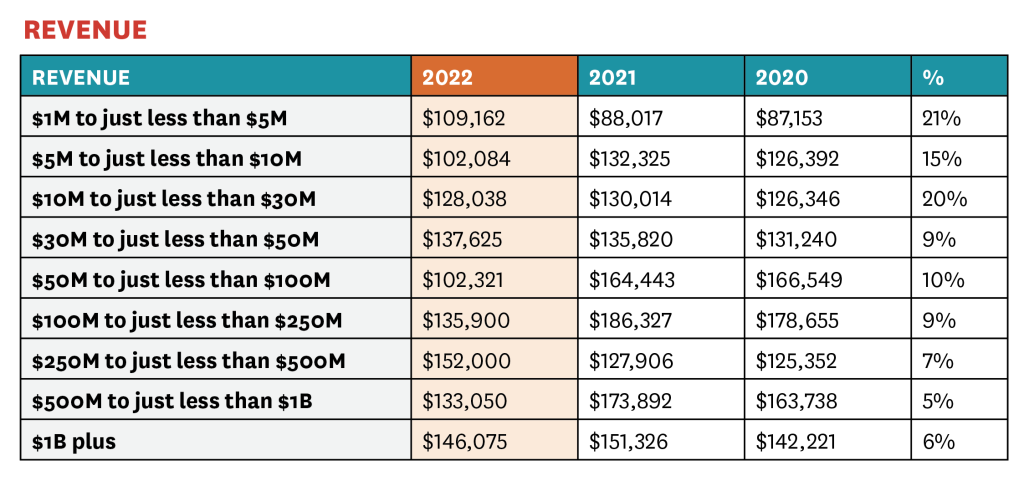

Looking at the COVID-19 period as an abnormal time, the drop in annual salary of nearly $10,000: $119,726 from $129,685, isn’t much of a shock. Comparing it to 2020, which shows a smaller drop from $125,452, and when comparing it to 2019, the last non-COVID year, it has only dropped by just under $3,500, from $123,204.

Looking at salaries by province (only including those which had at least five per cent of total respondents), we see that Quebec has the highest salary at $127,064, Ontario is next at $122,391, British Columbia at $112,270, and Alberta at $109,631. Other provinces had higher (Manitoba, PEI) or lower (all others); however, as these had only a few respondents, they cannot be considered accurate.

Photo: Plant Magazine.

Much like in 2021, this year most respondents (77 per cent) believe that over the next three years their salary will increase, with 32 per cent seeing a one to three per cent increase, 23 per cent a three to five per cent increase, 14 per cent a five to 10 per cent increase, and eight per cent seeing an increase over 10 per cent. On the flip side, 20 per cent don’t see any change to their salary in the next three years, and three per cent think their salary will decrease.

Photo: Plant Magazine.

Much like in previous years, survey respondents rated a healthy work life balance as an important aspect of job satisfaction again in 2022 (at 98 per cent); however, this years’ competitive salary (99 per cent) took the top spot, followed by comprehensive benefits package (94 per cent), vacation time (93 per cent), job security (89 per cent), and support for career and professional development (87 per cent).

When asked how satisfied respondents were with different aspects of their job, we found that while the numbers are in the 69 to 88 per cent range, satisfaction could still be higher. Overall, satisfaction with job security was the highest at 88 per cent, the job overall at 87 per cent, vacation time (81 per cent), compensation (81 per cent), healthy work life balance (78 per cent), benefits (74 per cent), and support received for career and professional development (69 per cent).

COMPANY PERSPECTIVE

Photo: Plant Magazine.

As we continue to look at a neo-COVID world, more companies are saw an increase in their revenues in 2021 (compared to 2020 or 2019). When asked “Thinking about 2021, would you say your company’s revenues have increased, decreased, or remained the same compared to 2020?”, 58 per cent said they have increased. Asking the same question but comparing to 2019, 56 per cent said they have increased.

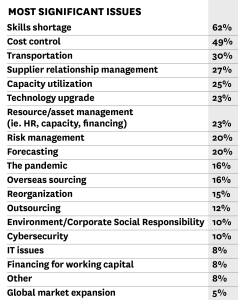

In 2022, when we asked respondents what the most significant issues their company will face in the coming year, skill shortage came out on top again at 62 per cent (up seven per cent from 2021), cost control (49 per cent), transportation (30 per cent), supplier relationship management (27 per cent), capacity utilization (25 per cent), technology update (23 per cent), resource and asset management (23 per cent), risk management (20 per cent), forecasting (20 per cent). The pandemic was only cited by 16 per cent (down from 68 per cent

in 2020).

Photo: Plant Magazine.

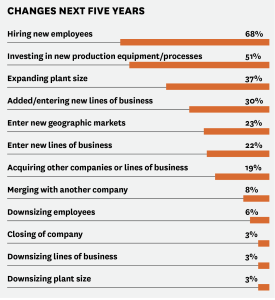

One thing that is constant, is change. Our final question asked respondents, “Thinking about the next five years, what changes do you anticipate occurring within your company?”

Most pressing, is hiring new employees (68 per cent), followed by investing in new production equipment and processes (51 per cent), expanding plant size (37 per cent), add new lines of business, (30 per cent), enter new geographic markets (23 per cent), enter new lines of business (22 per cent), and acquire companies or lines of business (19 per cent).

SALARY TABLES

Photo: Plant Magazine.

Photo: Plant Magazine.

Photo: Plant Magazine.

Photo: Plant Magazine.

Photo: Plant Magazine.

Photo: Plant Magazine.

________________________________

Research Methodology

Research was conducted online between March and June 2022 among 319 Canadian Manufacturing leaders in partnership with Excellence in Manufacturing Consortium. Results were prepared by the Canadian research firm Bramm Research Inc. www.brammresearch.com

–––––––––––––––––––––––––––––

Mario Cywinski is the editor of Plant magazine, Machinery and Equipment MRO magazine, Food and Beverage magazine, and a member of the Automobile Journalists Association of Canada. He has over 15 years of editorial experience; over four years of maintenance, reliability, and operations experience; nearly 20 years of automobile industry experience, and small business industry experience.