Canadian manufacturing PMI sinks deeper into contraction territory: report

By Plant staff

Economy Industry Operations Manufacturing Canadian goods canadian manufacturing international demand labour shortages manufacturing business operating conditions rates of decline US dollar

Photo: S&P Global.

The start of the fourth quarter indicated a third consecutive monthly drop in manufacturing business conditions in Canada. The rates of decline in both output and new orders quickened while firms continued to indicate a further shortage of skilled staff.

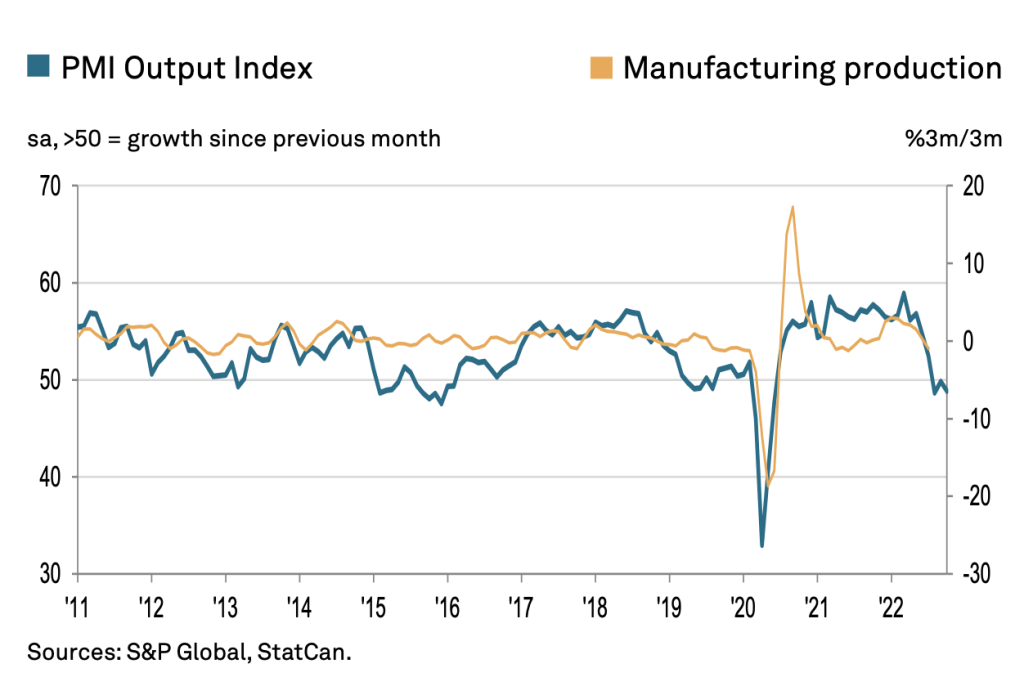

The S&P Global Canada Manufacturing Purchasing Managers’ Index (PMI) registered at 48.8 in October, down from 49.8 in September. The latest result pointed to a quicker deterioration in operating conditions, and one that was the second-strongest since the tail-end of the first wave of the COVID-19 pandemic in June 2020.

“Manufacturing businesses in Canada are continuing to consider their plans for the future, especially as the economic environment becomes increasingly difficult to navigate. Panel comments indicated higher interest rates and growing concerns of a recession weighed on output projections for the year ahead which slumped to a 29-month low,” said Shreeya Patel, economist, S&P Global Market Intelligence. “Positives can however be drawn from prices data which signalled another moderation in input cost inflation.”

Weak demand conditions were apparent in October’s survey data with firms often mentioning that high prices deterred demand. New orders fell solidly and at one of the quickest rates in the survey’s history. Export conditions were also subdued with international demand for Canadian goods contracting for the fifth month in succession.

Mirroring the trend for new orders, production levels declined with almost 16 per cent of firms recording a drop in output in October. Several factors were blamed for the fall including weak demand, labour shortages and supply troubles.

On the jobs front, voluntary resignations, staff retirements and shortages of skilled labour resulted in a modest fall in headcounts. A further decline in backlogs suggested firms were still able to keep-up with inflows of new work, however.

Input prices incurred by manufacturers in Canada increased, but the rate at which costs rose was the weakest for 23 months and only marginally above the long-run trend level. Despite this, firms hiked their selling charges sharply and at a quicker pace amid unfavourable exchange rate movements against the US dollar.

Looking ahead, while firms remained optimistic about their output levels in the year ahead, the degree of positivity was the weakest for 29 months. Firms hoped for greater demand and a recovery in labour force numbers, but there were growing concerns over a recession and the implications of higher interest rates.