PMI slips back into contraction territory during March, says S&P Global

By Plant staff

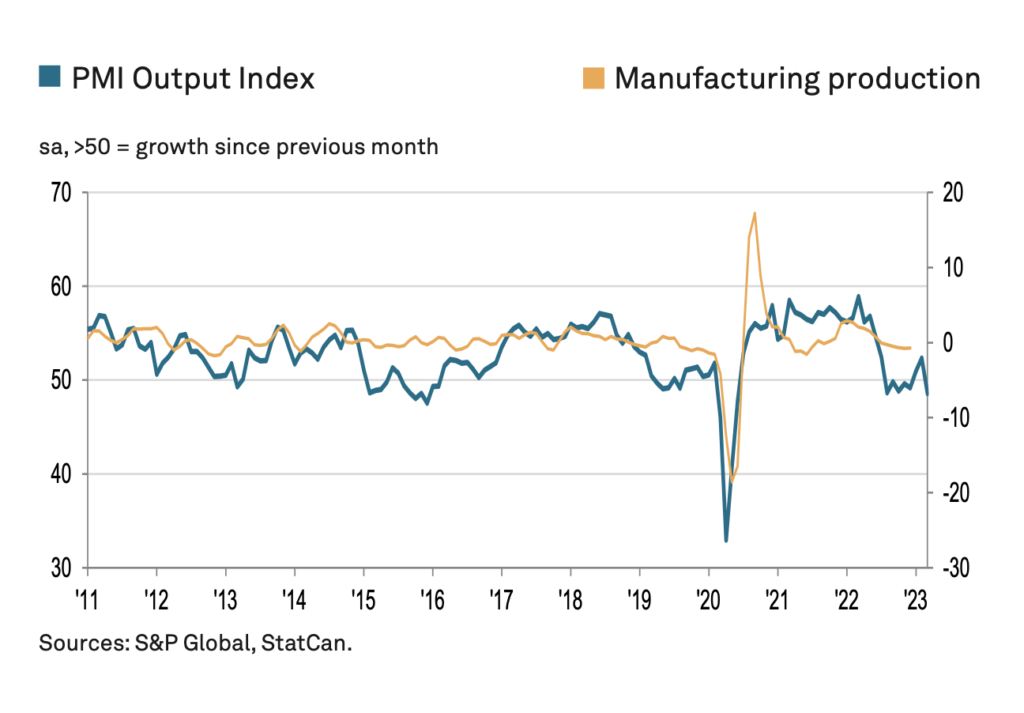

Business Operations Economy Industry Manufacturing Canada Manufacturing PMI S&P GlobalAfter accounting for seasonal factors, the S&P Global Canada Manufacturing Purchasing Managers’ Index (PMI) registered 48.6, down noticeably from 52.4 in February.

Photo: S&P Global Canada Manufacturing PMI.

Canada’s manufacturing sector returned to contraction territory during March, with the downturn led by concurrent falls in both production and new orders, according to the According to the March S&P Global Canada Manufacturing PMI. Higher prices remained a challenge, with costs rising again sharply, although with supply-side shortages generally reported to be less widespread, inflation trends remained downward. Firms also hired additional workers as confidence in the future improved.

After accounting for seasonal factors, the S&P Global Canada Manufacturing Purchasing Managers’ Index (PMI) registered 48.6, down noticeably from 52.4 in February. It was the lowest reading recorded by the index since June 2020 and represented a modest deterioration in operating conditions.

There were concurrent falls in both output and new orders during March, the first contractions of the year so far. The rate of decline in production was modest, with firms signalling the fall was closely linked to the steepest contraction of new orders since last October. Panellists noted that product markets were characterised by uncertainty and that purchasing power had been eroded by elevated inflation. These factors were common for both domestic and external clients: new export orders fell in March for a tenth successive month and to the sharpest degree since December.

Manufacturers also continued to report steeply rising prices. Input costs rose at a strong overall pace, with a wide range of goods and inputs again up in price since the previous month. However, the rate of inflation maintained the gentle downward trend evident since the turn of the year, dropping to its lowest since July 2020 and remaining below the long-run survey average. Companies signalled that this in part reflected a relative improvement in supply-side goods availability: although vendor performance was reported to have worsened again, average lead times lengthened only slightly and to the weakest degree since October 2019. There was evidence of fewer delays in shipping, with container availability said to have improved.

Slower overall input price inflation fed through to a similarly weaker gain in output charges, with manufacturers increasing their own prices to the slowest degree since October 2020. There were some reports that promotional discounts were required to entice buyers given a competitive marketplace and worsening sales in March. Softer demand also discouraged buying activity amongst Canadian manufacturers, who signalled a preference for utilising existing stocks at their plants.

Nonetheless, firms are expecting a pick-up in production over the coming 12 months amid hopes of economic recovery and a more stable demand environment. These factors should support sales and output, with firms suitably buoyed to take on additional staff for a fifth successive month. A combination of higher staffing levels, better productivity and relatively fewer component shortages meant firms were able to clear backlogs of work at their plants to the greatest degree for four months. They were also able to add to their inventories of finished goods slightly for the second time in 2023 so far.

“The recovery of Canada’s manufacturing economy stalled during March, with renewed falls in both production and new orders signalled. Broader macroeconomic uncertainty, and the negative impact of rising prices on client purchasing power were key factors that weighed on market demand,” said Paul Smith, economics director, S&P Global Market Intelligence.

“Nonetheless, despite these setbacks, there were some positive news to take from the survey, namely that price pressures continued to fall over the month amid reports of better supply-side stability. These are welcome developments given their roles in constraining manufacturing sector performance since the onset of the pandemic in 2020. And despite some residual challenges persisting – cost inflation remains high for instance – firms are growing in confidence, with optimism rising to its strongest in nearly a year and hiring activity being sustained.”