Pipeline obstructionism costing Canada billions

Elmira Aliakbari

Industry Energy Manufacturing Resource Sector energy gas manufacturing oil pipelines Trans MountainCanadian oil producers will lose $15.8 billion in revenue this year.

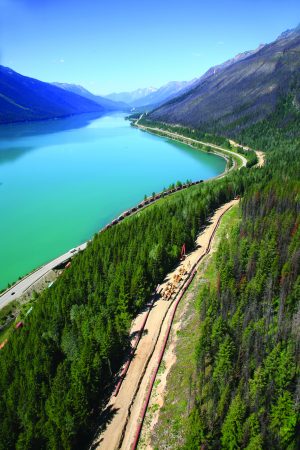

Trans Mountain pipeline parallels Moose Lake in Robson Provincial Park.

Photo: Kinder Morgan

Canada’s need for new pipelines is critical. The recent decision by Kinder Morgan, one of the largest energy infrastructure companies in North America, to halt all “non-essential spending” on the Trans Mountain pipeline expansion – which would run from Alberta, through BC, to the coast – made headlines across the country.

Stories have focused on interprovincial rivalries and trade wars. But an often ignored or misunderstood aspect of the pipeline debate is how much Canadians lose by not having sufficient pipeline capacity to deliver our oil to market.

According to a recent Fraser Institute study, Canadian oil producers will lose $15.8 billion in revenue this year.

Despite increased oil production in recent years, Canada has been unable to build any new major pipelines due to the cancellation of the Northern Gateway and Energy East projects, and ongoing delays in the Trans Mountain expansion, Line 3 replacement project and Keystone XL.

Take the Trans Mountain pipeline expansion, for example. The BC government continues to oppose the project, despite regulatory approval, and is pursuing legal means to regulate the movement of diluted bitumen through the province. Such political opposition raises serious concerns about whether the pipeline will actually be built.

So what are the consequences of all these delays? How is pipeline obstructionism affecting our energy industry?

Consequences include an overdependence on the US market, increased reliance on more costly modes of energy transportation and rising oil inventories in Western Canada.

Because of Canada’s lack of pipeline capacity, oil producers have been shipping their crude by rail, a higher-cost mode of transportation.

Higher rail rates mean Canadian oil producers absorb higher transportation costs, leading to lower prices for Canadian crude and a wider price differential.

Moreover, rail transport is less safe than pipelines and that’s bad news for people and the environment. In fact, pipelines are 2.5 times safer (i.e. less likely to experience an oil spill) than rail transport.

There’s always been a price difference between Western Canada Select (WCS) and US crude (West Texas Intermediate) due to transportation costs and the difference in quality between the two products. Between 2009 and 2012, the difference was roughly 13% (of the US crude price). And that difference was seen by producers as one of the costs of doing business in Canada.

But recently, this price difference has skyrocketed. In 2018, the average difference between Canadian oil (WCS) and US oil (WTI) – based on first-quarter data – was US$26.30 per barrel, which represents a discount of 42%.

Consequently, Canadian heavy oil producers will lose $15.8 billion this year in revenues compared to what other producers of similar products receive. That’s roughly 0.7% of our national economy lost because we can’t deliver our product to international markets to secure better prices.

Finally, this loss of revenue has far-reaching effects. It means less investment in Canada, less job creation for Canadian employers and workers, and less overall prosperity. Investment in Canada’s energy industry, particularly foreign investment, is collapsing. The federal government admitted as much by recently funding a study to find out why Canada’s industry, once a global leader, is now hemorrhaging investment.

The answer may seem self-evident to many Canadians, as obstructionism is now a constant feature on Canada’s energy scene.

Because pipelines take time to plan and construct, these losses will continue for the foreseeable future. There’s almost no way to stem these losses in the short term. Unless Canadians are willing to continue to incur large losses and less investment, policy-makers must ensure pipelines get built over the next two or three years.

Pipeline obstructionism is inflicting tremendous damage on the country

This article was co-written by Ashley Stedman. Stedman and Elmira Aliakbari are analysts with the Fraser Institute.

© Troy Media 2018